Latest Articles

Ventilation-Zone Engineering for Efficient Heat Dissipation During High Output

Ventilation-Zone Engineering for Efficient Heat Dissipation During High Output Introduction: The Thermal Imperative in Modern Power-Dense Systems As semiconductor node scaling appr…

Modular Hood System Compatible with Helmets and Goggles

Modular Hood System Compatible with Helmets and Goggles — A Comprehensive Technical, Ergonomic, and Operational Analysis Introduction: The Evolving Demands of Integrated Head Prote…

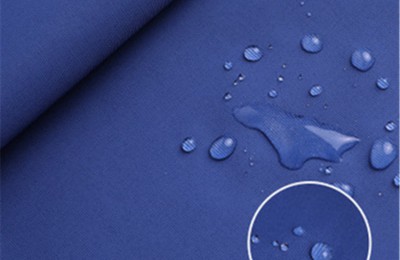

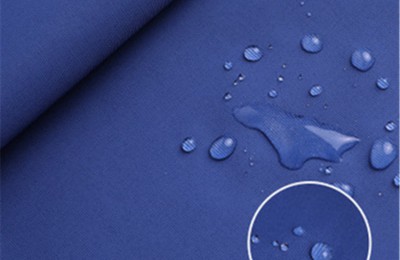

Eco-Conscious Recycled Polyester Outer Shell with DWR Finish

Eco-Conscious Recycled Polyester Outer Shell with DWR Finish — A Technical, Environmental, and Performance-Oriented Deep Dive Introduction: Rethinking Performance Textiles in the C…

Reflective Safety Elements Integrated into Low-Visibility Mountaineering Gear

Reflective Safety Elements Integrated into Low-Visibility Mountaineering Gear — A Technical, Ergonomic, and Regulatory Synthesis for Alpine Survival Introduction: The Imperative of…

4-Way Stretch Material Providing Unrestricted Mobility on Steep Ascents

4-Way Stretch Material Providing Unrestricted Mobility on Steep Ascents Overview In high-performance outdoor apparel—particularly for alpine mountaineering, technical trekking, and…

Seam-Sealed Construction Ensuring Maximum Storm Resistance

Seam-Sealed Construction Ensuring Maximum Storm Resistance Introduction: The Critical Role of Seam Integrity in Building Envelope Performance In high-wind and extreme-weather-prone…

Ultralight Packable Down Alternative for Rapid Temperature Shifts

Ultralight Packable Down Alternative for Rapid Temperature Shifts — A Technical, Material, and Environmental Performance Review Introduction: The Operational Imperative of Thermal …

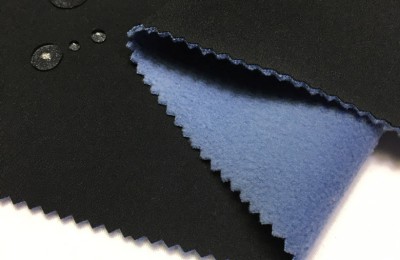

Abrasion-Resistant Softshell Designed for Technical Terrain Navigation

Abrasion-Resistant Softshell Designed for Technical Terrain Navigation — A Comprehensive Technical Monograph on Material Science, Ergonomic Architecture, and Field Performance Vali…

Moisture-Wicking Base Layer Optimized for Multi-Day Expeditions

Moisture-Wicking Base Layer Optimized for Multi-Day Expeditions Introduction: The Physiological Imperative of Thermal & Hygric Regulation in Extended Field Operations In high-a…