As Southeast Asian countries relax entry restrictions and consumer expectations improve, demand for orders from Southeast Asian countries will rebound in a “retaliatory” manner, and the Southeast Asian export transportation market will become even hotter.

Take Vietnam as an example. Since Vietnam opened entry to the country in mid-March, Vietnam’s total import and export of goods trade in March reached US$66.73 billion, a month-on-month increase of 36.8%. Among them, exports were US$34.06 billion, an increase of 45.5%; imports were US$32.67 billion, an increase of 28.7%. At present, the freight rate for some container types on the shipping route from North China to Ho Chi Minh has increased by more than 50%.

It can be seen that the foreign trade of Southeast Asian countries is recovering rapidly, which has caused orders that previously returned to China to begin to flow out again.

New pressure on foreign trade, the phenomenon of canceled orders has increased sharply

According to the national According to the Bureau of Statistics, China’s industrial capacity utilization rate in the first quarter was 75.8%, a decrease of 1.4% from the same period last year; the manufacturing capacity utilization rate was 75.9%, a decrease of 1.7%.

As industrial and manufacturing capacity utilization rates decline, energy and raw material prices soar. In addition to the “increased outflow” of foreign trade orders in China, another type of The new pressure cannot be underestimated, and the phenomenon of canceled orders has increased sharply.

Guan Tao, global chief economist of BOC Securities, said that the current economic operation is facing greater uncertainty and challenges. From an external perspective, geopolitical conflicts have intensified and the momentum of global economic recovery has been weakened, which may accelerate the narrowing of China’s trade surplus.

At the same time, although China’s economy has taken the lead in resuming work and production, its export pricing ability is limited. If some foreign businessmen are worried that logistics is not guaranteed, they will place many orders at the same time. Whoever delivers the goods first will have to pay the balance to the person who will lose the deposit at most. But this will create competition among Chinese exporters.

Vietnam’s manufacturing industry has recovered strongly

Among Southeast Asian countries, Vietnam’s performance Especially eye-catching. The General Administration of Vietnam Customs announced that Vietnam’s total import and export of goods trade in the first quarter reached US$176.35 billion, a year-on-year increase of 14.4% (a net increase of US$11.17 billion). In particular, the growth rate of agricultural exports is quite high, about 18-19%.

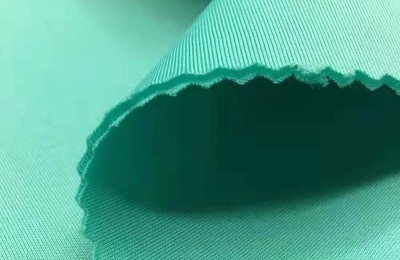

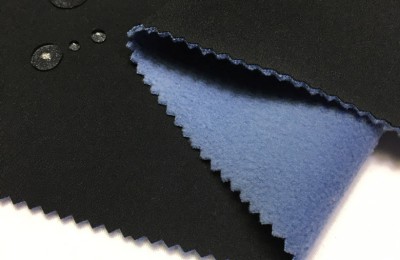

In addition, the export momentum of the garment manufacturing industry is strong. It is understood that orders from many local textile companies have even been scheduled into the third quarter of this year. The strong recovery of Vietnam’s textile and apparel exports is due on the one hand to the increase in clothing demand in the EU market and China’s cotton yarn import demand, and on the other hand to the rapid vaccination of China’s vaccines.

Chinese textile leader Lu Thai Textile has also begun to focus on the Southeast Asian market again. Its wholly-owned subsidiary Wanxiang Textile has planned a total investment of approximately US$210 million in Xining Province, Vietnam.

In addition, in order to further stabilize the development of the country, Vietnam has determined the country’s ambitions for the country’s short-term and long-term development. Specific goals are set in three stages, called the “Three Phases”. “Develop strategic goals.

The first stage: by 2025, the per capita income will exceed US$4,000 and become a developing country with a modern industrial foundation. The second stage: building a developing country with modern industry with a per capita income of US$4,000-12,000 by 2030. The third stage: building a modern socialist developed country with a per capita income of more than 12,000 US dollars in 2045.

Labor is cheap and the market is active

According to Vietnam’s import and export in the first quarter According to trade data, industry insiders in Vietnam predict that at the current growth rate, the country’s import and export volume may reach a new high in 2011, reaching US$700 billion. Among them, the Ministry of Industry and Trade has set an export target of US$363 billion, an increase of 6-8% compared with 2021, and is premised on maintaining a certain degree of trade surplus.

In addition, the General Bureau of Statistics of Vietnam recently released a report that in the first quarter of 2011, China’s labor market in many industries gradually became active, and workers’ income improved significantly. The average monthly income of workers in Ho Chi Minh City is the highest in China, at 8.9 million dong (about 2,480 yuan), an increase of 36.5% from the previous quarter, or 2.4 million dong (about 670 yuan).

This data is significantly lower than that in China. According to the National Bureau of Statistics, the annual salary of manufacturing and related personnel is 65,241 yuan, and the average monthly income is about 5,437 yuan.

Due to cheap labor, foreign companies have set their sights on Southeast Asian countries such as Vietnam, such as Samsung, Foxconn, Microsoft, Intel, Panasonic and other international giants.

In addition, in order to further attract foreign investment, Vietnam has also signed a free trade agreement with the European Union, reducing 99% of tariffs; formulating policies to attract foreign investment, such as reducing tariffs to attract foreign companies in the country Build a factory. This initiative has made good progress, and many foreign companies have withdrawn their businesses in China in view of this.

It is not difficult to foresee that for a long time in the future, it is inevitable that the price of textile and clothing will continue to rise. The textile and clothing manufacturing industry will have to adopt overseas investment methods. to absorb various rising cost pressures.

However, in the textile and clothing manufacturing supply chain, China’s manufacturing still ranks first in the world; but Southeast Asia’s manufacturing industry also has an absolute advantage. In the face of slowing global demand and Today, fast fashion discount retailers are in vogue, and the “��”Sweatshops” are difficult to disappear. At the same time, it is a reality that we have to face. The rising textile industry in Southeast Asian countries is becoming the main competitor of Chinese textile companies. In the foreign trade situation where price advantages are gradually losing, Chinese textile companies are also facing difficulties. Challenges.

China also proposed during the two sessions: to promote high-quality economic development, we must focus on promoting the transformation and upgrading of the industrial structure and make the real economy solid and strong. Being excellent means that the country has embarked on a new journey of high-quality development.</p